As a trusted lender with years of experience in the financial services industry, Direct Credit Funding understands the challenges faced by small businesses in today's dynamic market. Our equipment financing programs are designed to address both informational needs—such as understanding loan terms and benefits—and transactional intents, like applying for quick funding. We offer competitive rates starting as low as 4% APR for qualified applicants, with terms up to 7 years, based on industry standards from sources like Bankrate and LendingTree. This allows you to spread costs over time, preserving working capital for other priorities like inventory or marketing.

One of the key advantages of equipment financing is its accessibility. Unlike traditional bank loans that may require extensive collateral or perfect credit, our programs cater to a range of credit profiles, often approving applications within 24 hours. For instance, according to SBA guidelines, small businesses must be for-profit, U.S.-based, and meet size standards to qualify for similar funding, but we extend options to startups with down payments as low as 10-20%. This inclusivity makes equipment financing ideal for entrepreneurs in industries like manufacturing, healthcare, or agriculture, where equipment costs can exceed $100,000.

Moreover, equipment financing comes with significant tax perks. Under IRS Section 179 guidelines, businesses can deduct the full cost of qualifying equipment—such as computers, vehicles, or production tools—up to certain limits in the year it's placed in service, potentially reducing your taxable income substantially. This not only accelerates ROI but also enhances cash flow management. At Direct Credit Funding, we guide you through these benefits, ensuring your financing aligns with your business goals.

Our commitment to E-A-T principles means all our advice is rooted in reliable industry knowledge, drawing from resources like the SBA and IRS. We're not just a lender; we're a partner in your success, offering personalized consultations to match financing to your needs. Ready to elevate your operations? Explore our equipment financing options today and take the first step toward sustainable growth.

To qualify, businesses typically need at least two years in operation, a credit score of 600 or higher, and annual revenue around $200,000, though startups may qualify with a 10-20% down payment or strong business plan, per eligibility criteria from sources like Bankrate and Credibly. Interest rates vary from 4% to 25% APR, influenced by factors like creditworthiness, loan term (1-7 years), and equipment type, as noted in 2025 data from Lendio and Crestmont Capital. For example, a warehouse business financing a $50,000 forklift might secure a 5-year loan at 7% APR, resulting in manageable monthly payments of about $1,000.

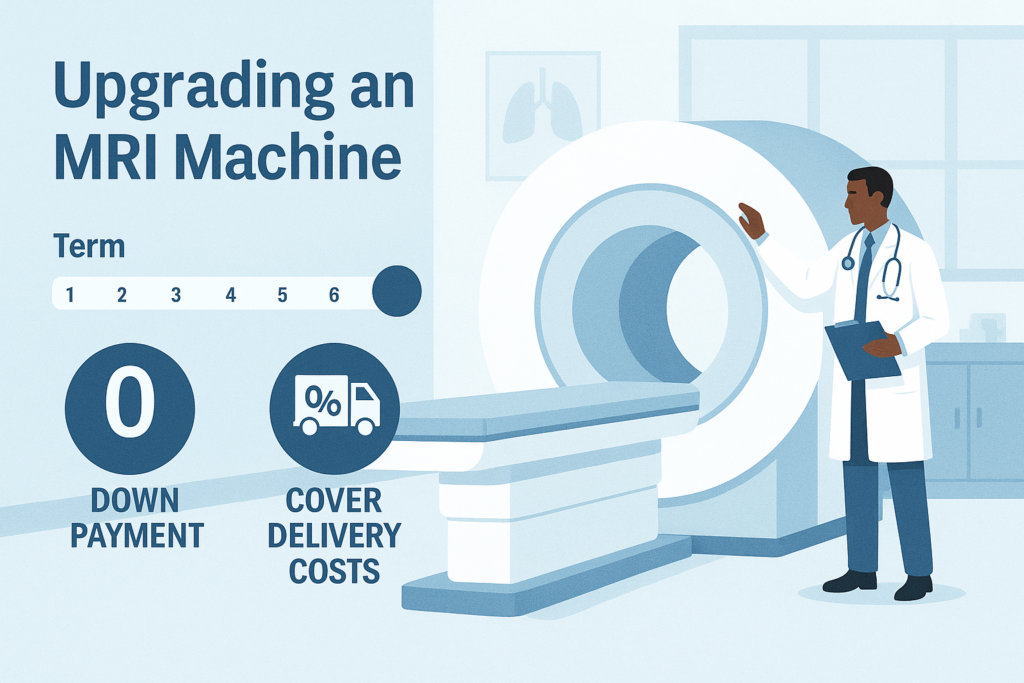

Pros of equipment financing include preserving cash flow by avoiding large upfront costs, potential tax deductions under IRS Section 179 (e.g., deducting up to the full cost of qualifying machinery in one year), and ownership benefits like depreciation write-offs. It also enables quick access to modern equipment, boosting productivity—imagine a restaurant owner financing commercial ovens to increase output by 30%. Additionally, 100% financing is common for qualified applicants, as offered by competitors like Crest Capital, covering not just the purchase but installation and shipping.

However, there are cons to consider. Loans are limited to equipment purchases only, potentially requiring down payments of 10-20%, and the loan term might outlast the equipment's useful life, leading to ongoing payments for outdated assets. Depreciation risks mean the equipment's value drops over time, and higher interest rates for lower-credit borrowers can increase total costs. In scenarios like economic downturns, businesses might face repossession if payments falter, as the equipment secures the loan.

Real-world examples illustrate this balance. A construction firm might finance excavators to bid on larger projects, enjoying tax savings but needing to plan for maintenance costs. Conversely, a medical practice leasing diagnostic tools avoids obsolescence but misses ownership perks. Overall, equipment financing is a strategic choice for growth-oriented businesses, offering flexibility when traditional funding falls short. By weighing these factors, entrepreneurs can make informed decisions aligned with their operational needs and financial health.

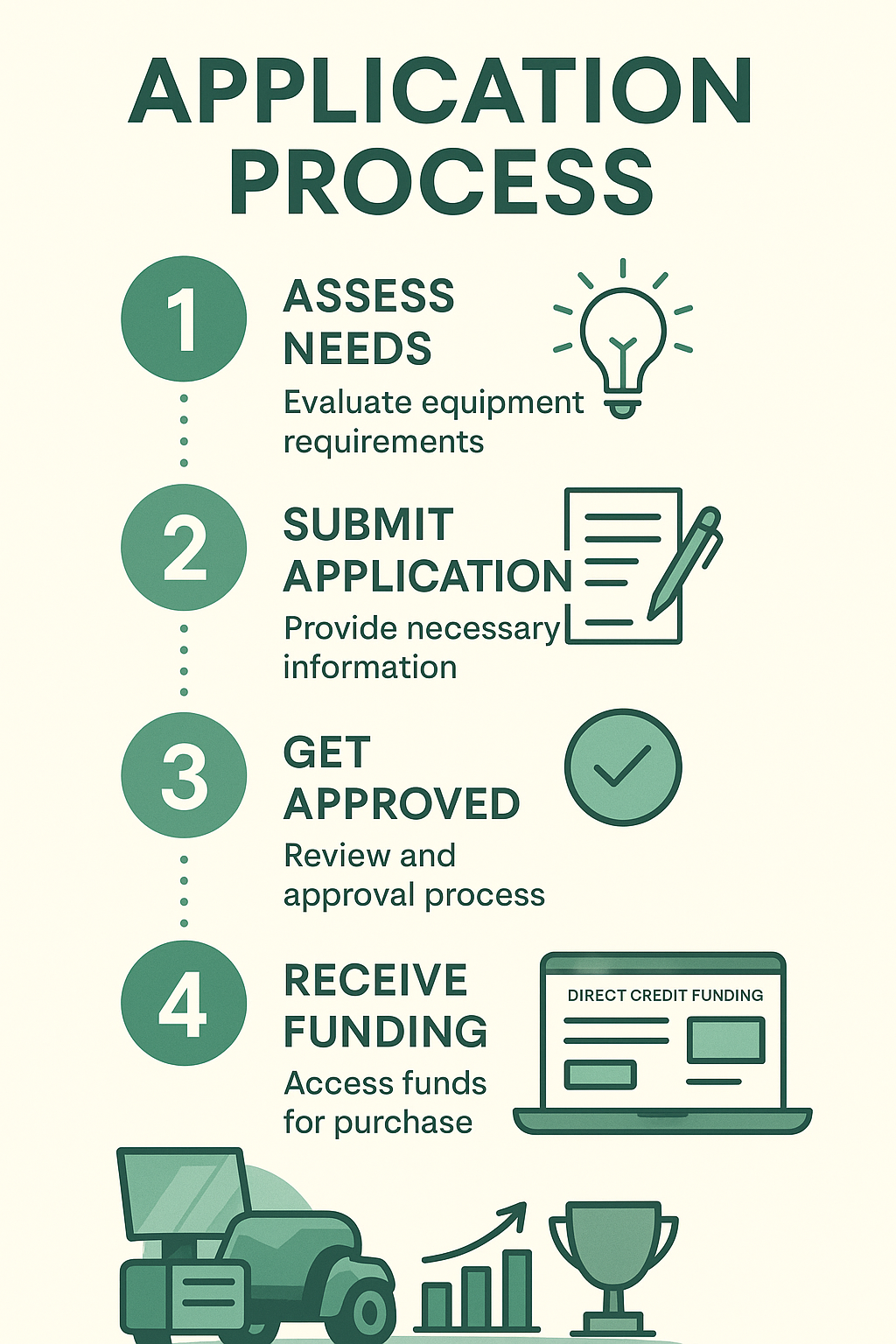

Applying for equipment financing with Direct Credit Funding is straightforward and designed for busy entrepreneurs. Follow these steps for a smooth process:

This process aligns with SBA-recommended practices for efficiency. Expect competitive terms, but ensure your business meets basics like being U.S.-based and for-profit. If issues arise, our experts are here to help—apply today!

At Direct Credit Funding, we finance a wide array of equipment to support diverse industries, ensuring your business has the tools for success. Here's a breakdown:

Our financing includes used equipment, with rates starting at 7% APR for qualified borrowers. Whether new or refurbished, we ensure affordability and reliability.