In today’s fast-paced business world, staying liquid while keeping operations running smoothly is a top priority. That’s where a sale-leaseback comes in—a smart financial strategy that’s gaining traction among business owners. According to the Equipment Leasing and Finance Association, the U.S. equipment finance industry hit a staggering $1 trillion in 2023, with sale-leaseback deals making up a hefty chunk. So, what’s this all about? Simply put, a sale-leaseback lets you sell your equipment to a financier and lease it right back, giving you a quick cash boost without losing access to the tools you need. For businesses looking to free up capital, fund growth, or upgrade equipment, it’s a game-changer. At Direct Credit Funding, we’re here to make it happen—connecting you with the best lending options tailored to your needs. Visit directcreditfunding.com, and let’s find the perfect financing solution for you.

What is Sale Lease Back and How Does It Work?

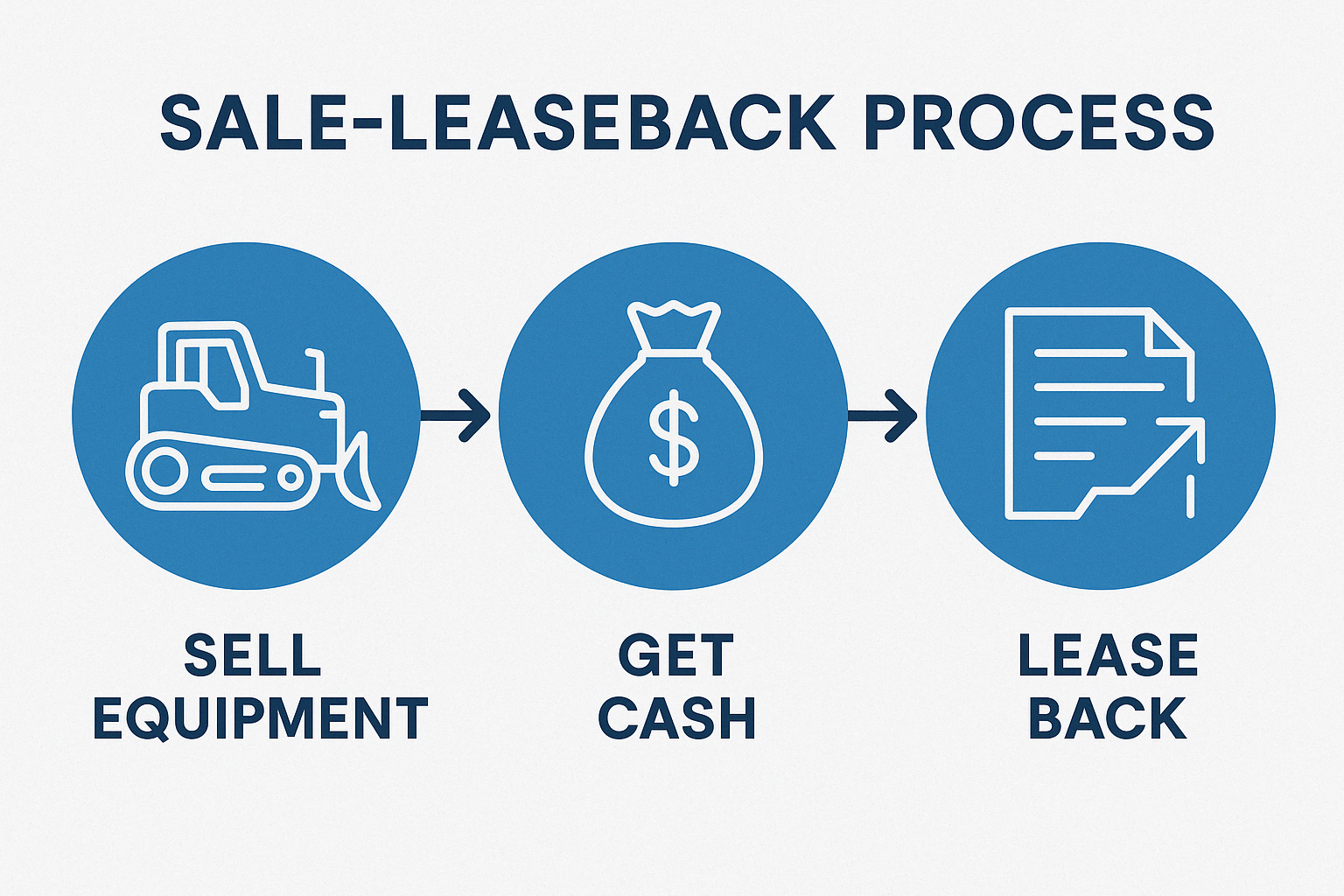

Imagine this: your business owns valuable equipment—think manufacturing machines, delivery trucks, or even high-tech gear. A sale-leaseback lets you turn that equity into cash. Here’s how it works: you sell the equipment to a lessor (a financing partner), pocket a lump sum, and then lease the equipment back with regular payments. The beauty? You keep using the equipment like nothing’s changed, but now you’ve got extra capital to play with. Whether it’s heavy machinery or office tech, sale-leaseback applies across industries. At Direct Credit Funding, we streamline this process, matching you with lenders who get your business and offer terms that fit.

Benefits of Sale Lease Back for Businesses

Why go for a sale-leaseback? Let’s break it down:

- Cash on Hand, Fast: Selling your equipment unlocks capital tied up in assets—perfect for covering unexpected expenses or seizing new opportunities.

- Better Cash Flow: That lump sum can smooth out cash flow bumps, fund projects, or reduce debt, keeping your business agile.

- Tax Perks: Lease payments might be deductible as operating expenses, potentially lowering your tax bill (chat with your accountant to confirm).

- Future Flexibility: When the lease ends, you can upgrade to newer gear, extend the lease, or buy the equipment back—your call.

A National Business Capital survey found that 60% of small businesses use equipment financing, and sale-leaseback is a top pick for those needing capital without disruption. It’s especially handy if you’ve got equity in equipment but your cash reserves are tight.

Common Challenges and How to Overcome Them

Sale-leaseback isn’t without its hurdles, but they’re manageable—especially with the right partner:

- Finding a Trustworthy Lessor: Not every financier understands your industry or offers fair terms. It can feel like a maze.

- Matching Your Goals: The lease needs to align with your financial plans—too short, and you’re rushed; too long, and it drags.

- Accounting and Tax Headaches: The rules around sale-leaseback can get tricky—think operating vs. capital leases and their tax impacts.

That’s where Direct Credit Funding shines. We’ve got a network of lenders we trust, and our team guides you through the details—finding deals that work for you and simplifying the paperwork. We’re not just about closing a deal; we’re about setting you up for success.

Why Choose Direct Credit Funding for Your Sale Lease Back Needs

So, why team up with Direct Credit Funding? We’re not your average financing middleman. Here’s what sets us apart:

- Know-How: We live and breathe equipment financing—sale-leaseback included—and we know the ins and outs.

- Your Business, Your Plan: We dig into what you need and craft solutions that fit like a glove.

- Speedy and Simple: Our process cuts the red tape—approvals can happen in as little as 24 hours.

- Top-Notch Options: We tap our lender network to bring you competitive rates and flexible terms.

Picture this: we assess your equipment and goals, then scour our contacts for the best match. You get cash fast without the stress. That’s the Direct Credit Funding difference.

Success Stories: How Businesses Have Leveraged Sale Lease Back

Real-world wins show how sale-leaseback pays off. Take a manufacturing company strapped for expansion cash. They sold their machinery in a sale-leaseback deal, netting $2 million. With that, they bought more equipment, hired staff, and boosted production—all without missing a beat. Or consider a transportation firm with an aging fleet. They sold their old trucks, leased back newer ones, and cut maintenance costs while keeping cash in reserve. Even in healthcare, a hospital used sale-leaseback on its MRI machines to raise $5 million, upgrading tech and improving patient care. These businesses turned equipment into opportunity—Direct Credit Funding can do the same for you.

How to Get Started with Sale Lease Back

Ready to explore sale-leaseback? Here’s your roadmap:

- Check Your Gear: Pinpoint equipment you own outright—its value, condition, and role in your operations.

- Know Your Needs: Figure out how much cash you want and what you’ll do with it—growth, debt, or something else?

- Reach Out: Hit up directcreditfunding.com. We’ll chat about your business and scout the best lending options.

- Weigh the Offers: Look over lease terms—rates, timelines, and endgame choices—with our help.

- Seal the Deal: Pick your lessor, sign on, grab your capital, and start leasing back.

It’s straightforward, and we’re with you every step—making sure it’s a win for your business.

Conclusion

Sale-leaseback is more than a financing trick—it’s a lifeline for businesses needing capital without chaos. Whether you’re a manufacturer, a transporter, or a healthcare provider, it’s a way to keep your equipment humming while fueling your next big move. At Direct Credit Funding, we’re all about finding you the right lending options—fast, tailored, and hassle-free. Curious? Swing by directcreditfunding.com and let’s talk about how sale-leaseback can work for you. Your equipment’s value is waiting to be unlocked—let’s make it happen.