Starting over after bankruptcy can feel like an uphill battle, especially when your business needs equipment to get back on track. If your company has a history of bankruptcy, you’ve probably hit roadblocks when trying to secure financing—high interest rates, strict requirements, or flat-out rejections. But there’s hope. Businesses with a past bankruptcy can still find financing solutions tailored to their needs, and Direct Credit Funding is here to help. Specializing in equipment financing, we connect businesses like yours with lenders who offer the best options, even if your credit history isn’t perfect.

So, what does “Former BK Bankruptcy Financing” mean? It’s all about helping businesses that have previously filed for bankruptcy (often abbreviated as “BK”) get the funding they need to move forward. This is incredibly relevant because, post-bankruptcy, businesses often struggle to access traditional loans, yet they need equipment to operate, compete, and grow. At Direct Credit Funding, we step in to bridge that gap, finding personalized financing solutions so you can rebuild with confidence. In this article, we’ll dive into why this matters, the challenges you might face, and how we can help you secure the equipment financing you need.

Understanding Bankruptcy and Its Impact on Financing

Bankruptcy is a legal lifeline for businesses drowning in debt they can’t repay. It’s a chance to restructure or wipe the slate clean, but it comes with a catch: a damaged credit profile. Lenders see a past bankruptcy as a red flag, labeling your business as high-risk. That label sticks around, often for years, making it tough to secure loans or financing for things like equipment.

For business owners, this creates a frustrating paradox. You need tools—whether it’s machinery, vehicles, or tech—to generate revenue and recover, but your bankruptcy history slams the door on traditional funding options. This is where specialized financing comes into play, and it’s exactly what “Former BK Bankruptcy Financing” is all about—getting you the resources you need despite your past.

The Importance of Equipment for Business Recovery and Growth

Equipment isn’t just a nice-to-have; it’s the heartbeat of many businesses. Whether you’re in construction, manufacturing, or even running a small restaurant, having the right tools can make or break your success. After bankruptcy, this becomes even more critical. Here’s why:

- Efficiency: Modern equipment saves time and cuts costs, letting you do more with less.

Competitiveness: Outdated tools put you at a disadvantage; new equipment keeps you in the game.

Revenue: From delivery vans to production lines, the right gear opens up new opportunities to earn.

For businesses climbing out of bankruptcy, investing in equipment isn’t optional—it’s a lifeline. But when traditional lenders won’t budge, where do you turn? That’s where Direct Credit Funding shines, connecting you with lenders who see your potential, not just your past.

Financing Challenges for Businesses with a History of Bankruptcy

If you’ve tried to secure financing after bankruptcy, you know the drill. The obstacles can feel endless:

- High Interest Rates: Lenders might offer a loan, but the rates can be punishing, eating into your profits.

Strict Requirements: Many banks want years of spotless financials post-bankruptcy—time you don’t have when you’re trying to rebuild now.

Limited Options: Some lenders won’t even consider you, shrinking your pool of possibilities.

It’s a tough spot to be in. You’re ready to move forward, but the financial world seems stuck on your past. Fortunately, there’s a way around these hurdles, and it starts with finding lenders who specialize in working with businesses like yours.

How Direct Credit Funding Solves These Challenges

At Direct Credit Funding, we get it—your business isn’t defined by a bankruptcy filing. Our mission is to help you secure equipment financing by matching you with lenders who offer solutions tailored to your situation. Here’s how we do it:

- Personalized Matching: We dig into your business’s needs—what equipment you’re after, your budget, your goals—and pair you with lenders who are a good fit.

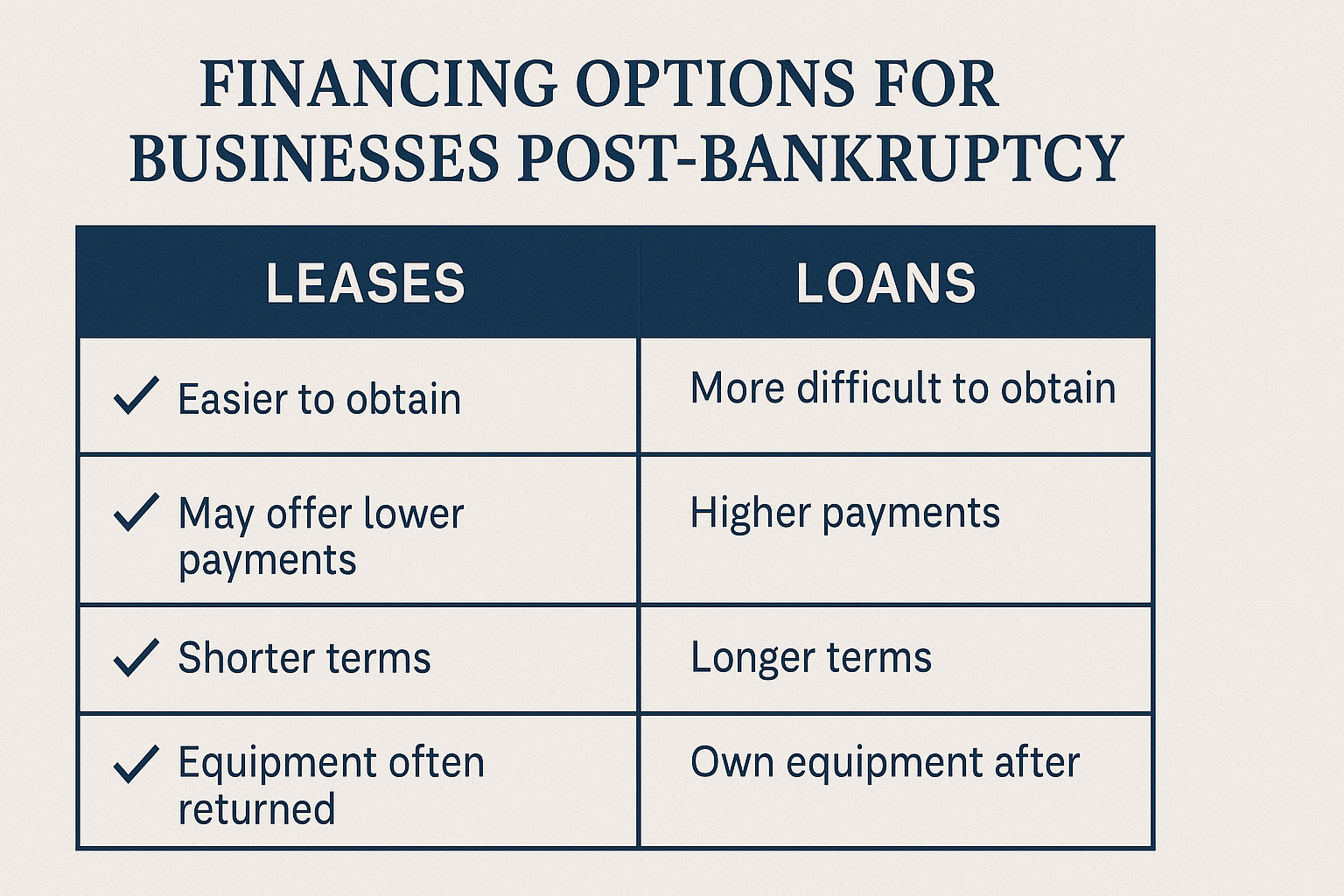

Flexible Options: From equipment leases to loans with manageable terms, we work with partners who offer lower down payments and rates that won’t choke your cash flow.

Fast Approvals: Time matters. Our network of lenders moves quickly, so you’re not left waiting when you need equipment yesterday.

Think of us as your financing GPS, guiding you to the best routes when the usual paths are blocked. Ready to explore your options? Visit directcreditfunding.com and let’s get started.

Success Stories: Rebuilding After Bankruptcy

Picture this: A small construction company hits rock bottom after losing a major contract, filing for bankruptcy to survive. Their old equipment can’t keep up with demand, but banks won’t touch them. They turn to Direct Credit Funding, and we connect them with a lender offering an equipment loan with flexible terms. Within a month, they’ve got new machinery, new projects, and a new lease on life.

Or take a retail store that went under during a rough patch. To reopen stronger, they needed updated point-of-sale systems and shelving. Traditional financing was out of reach, but through Direct Credit Funding, they secured a lease that fit their budget. Today, they’re back in business, serving customers better than ever.

These aren’t just stories—they’re proof that with the right support, businesses can rise above bankruptcy and thrive.

Industry Trends and Insights

Bankruptcy isn’t rare—over 20,000 businesses file annually in the U.S., according to recent stats. But here’s the kicker: about 70% of those that recover credit strategic investments like equipment as a key factor. Financing isn’t just a tool; it’s a game-changer for businesses starting over.

The equipment financing world is evolving too. Lenders are waking up to the fact that a past bankruptcy doesn’t mean future failure. More are offering programs with looser criteria, designed for businesses in your shoes. At Direct Credit Funding, we stay ahead of these shifts, ensuring you get access to the latest and greatest options out there.

Why Choose Direct Credit Funding?

When you’re navigating financing after bankruptcy, you need more than a lender—you need a partner. Here’s why Direct Credit Funding stands out:

- Expertise: We live and breathe equipment financing, with a network of lenders ready to say yes when others say no.

Tailored Solutions: Your business is unique, and we treat it that way, finding options that match your specific needs.

Trust: We’re in this to help you succeed, with clear guidance every step of the way.

Don’t let a past bankruptcy hold your business back. Visit directcreditfunding.com today and see how we can help you get the equipment you need to grow.

Conclusion

Bankruptcy might feel like a dead end, but it’s really just a detour. With the right financing, you can equip your business for a comeback—and Direct Credit Funding is here to make that happen. We specialize in connecting businesses with a history of bankruptcy to lenders who offer the best equipment financing solutions. It’s about more than money; it’s about giving you the tools to rebuild and succeed.

Take the next step toward recovery. Check out directcreditfunding.com and let us find the financing that fits your business, no matter where you’ve been.