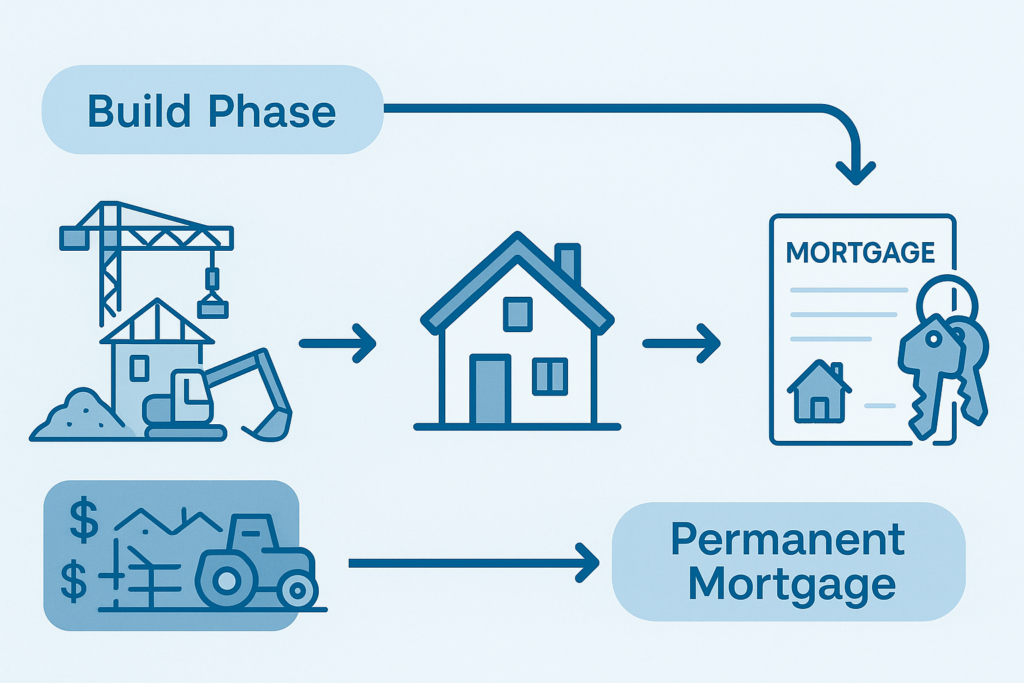

Construction financing, also known as construction loan financing, is a specialized short-term loan designed to fund the building or major renovation of residential, commercial, or real estate properties. Unlike traditional mortgages that finance completed homes, construction financing disburses funds in stages as the project progresses, ensuring you only pay interest on the amount used.

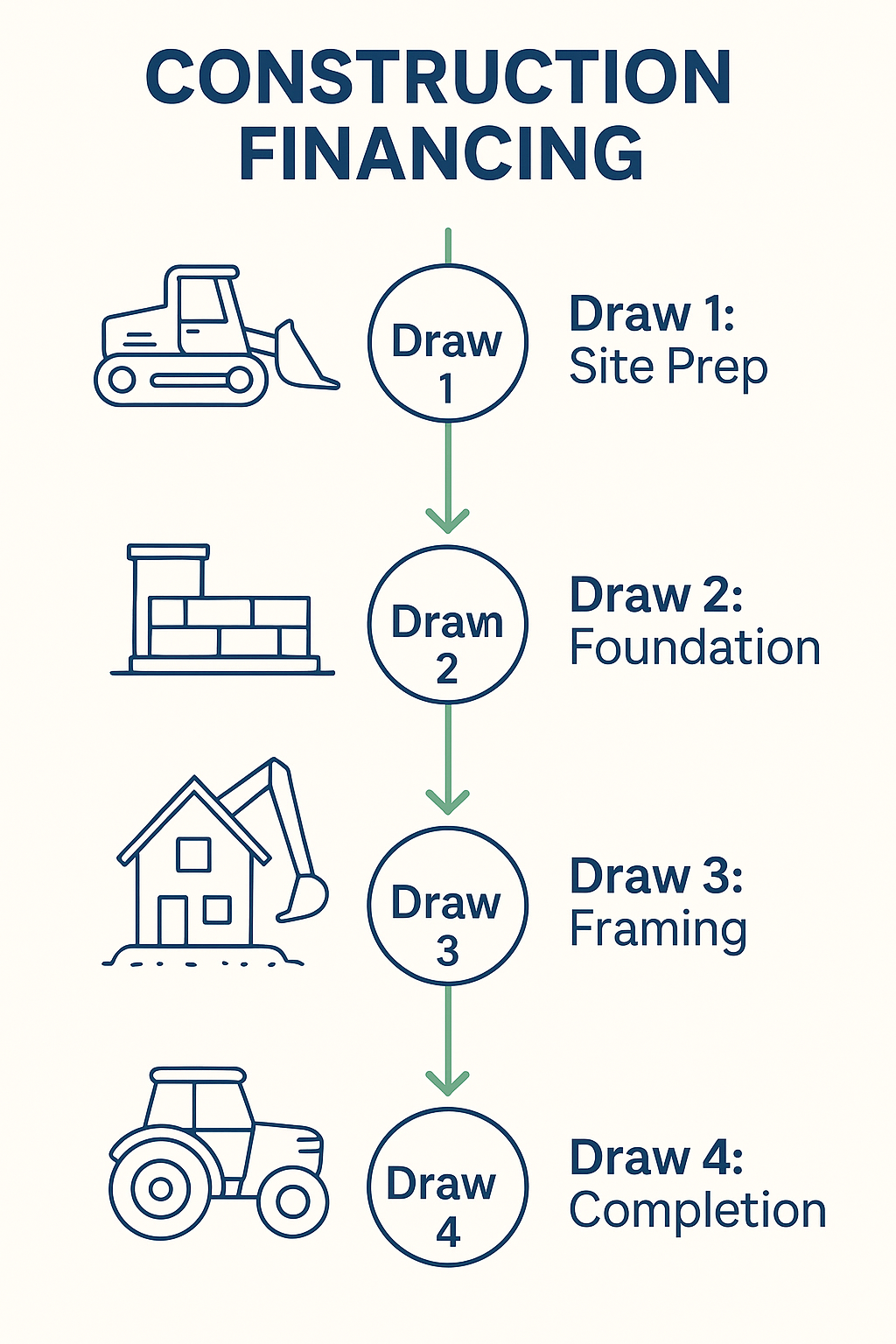

At its core, construction financing covers expenses such as land acquisition, building materials, contractor labor, permits, and architectural fees. Once the project is finished, the loan typically converts into a long-term mortgage or is refinanced. According to Investopedia, it's a vital tool for real estate development, helping manage cash flow during the build phase. Key components include draw schedules (phased fund releases), interest-only payments during construction, and inspections to verify progress.

The process begins with approval based on your project plans and financials. Funds are released in "draws" aligned with milestones, like foundation completion or framing. Bankrate explains that this staged approach minimizes risk for lenders and borrowers alike. For example, a $500,000 project might have draws of $100,000 for site preparation, $200,000 for structure, and so on, with interest calculated only on disbursed amounts.

Opting for construction financing offers numerous advantages for builders and developers, making it a popular choice for custom projects.

One major benefit is flexible draw schedules that match project phases, helping maintain cash flow. Rocket Mortgage highlights how this allows borrowers to build dream homes without upfront capital depletion. Additionally, potential tax deductions under Section 179 for equipment can reduce costs, as noted by the IRS guidelines.

To qualify, lenders like us assess creditworthiness and project viability. Typical requirements include:

For startups or corporate-only funding, we offer flexible programs to accommodate emerging developers.